portability estate tax exemption

The basic exclusion amount is the amount a person can pass to their heirs tax-free through lifetime gifting or at death. This is the same amount as the New York exemption which was based on.

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

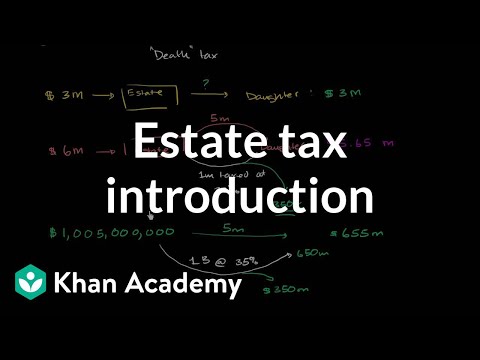

Each year the government sets a tax exemption limit or exclusion amount for estates under a certain size.

. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the surviving. Two important aspects to remember are that the portability exemption is only available to married couples and only applies to Federal estate taxes. Currently the limit is set at 1158 million in combined assets for a decedent who dies in 2020 and is expected to remain at this level until at least 2025.

Under the portability provisions the surviving spouse is allowed to use the unused portion of the predeceased spouses estate tax exemption. For estates that exceed this amount the top tax rate is 40. The tax for the estate would be 568000 at a 40 tax rate.

The portability feature means that when one spouse dies and his or her estate value does not use up to the total available estate tax exemption the unused portion of the estate tax exemption is then added to the available estate tax exemption for the. However by applying for portability of the first to dies unused exemption when heshe passes away the surviving spouse can use the 9580000 unused exemption amount plus their 11580000 exemption amount to make the 568000 tax go away. The portability of the federal estate tax exemption for married couples eliminated the need to plan in such a way.

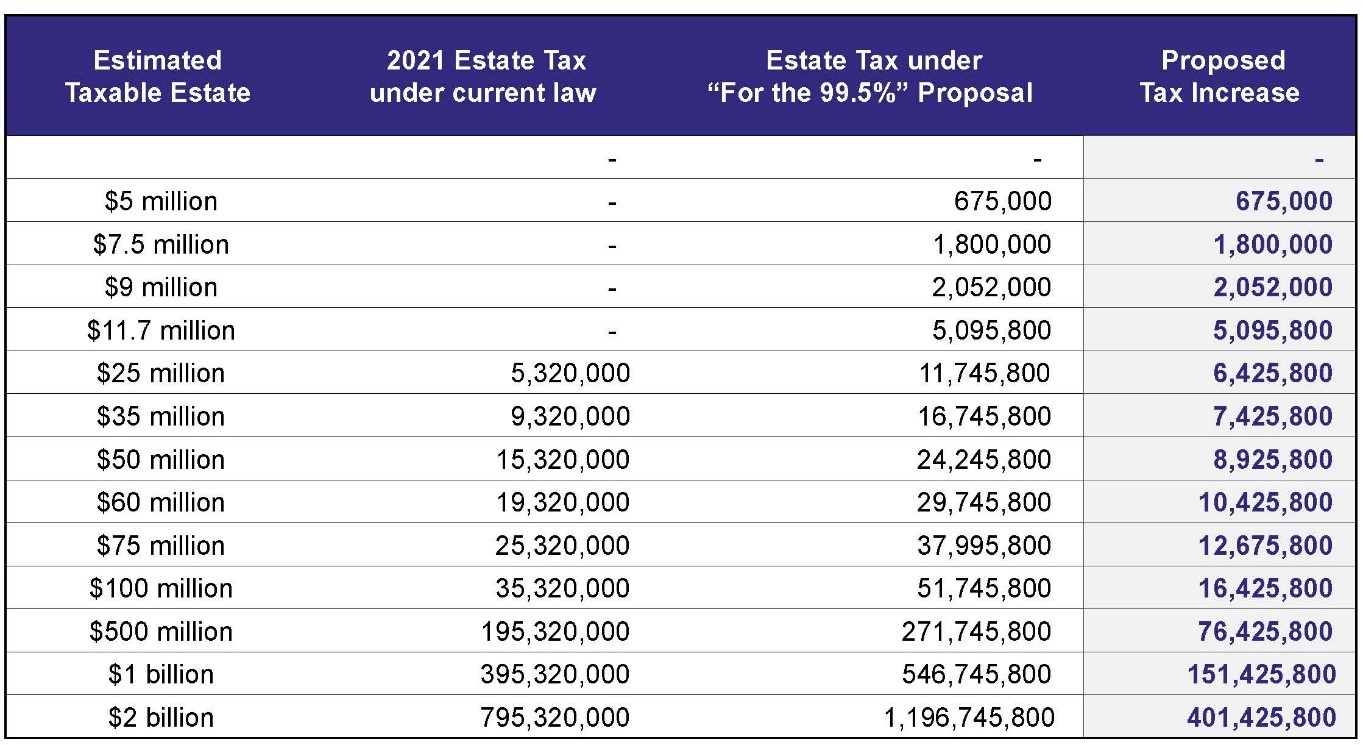

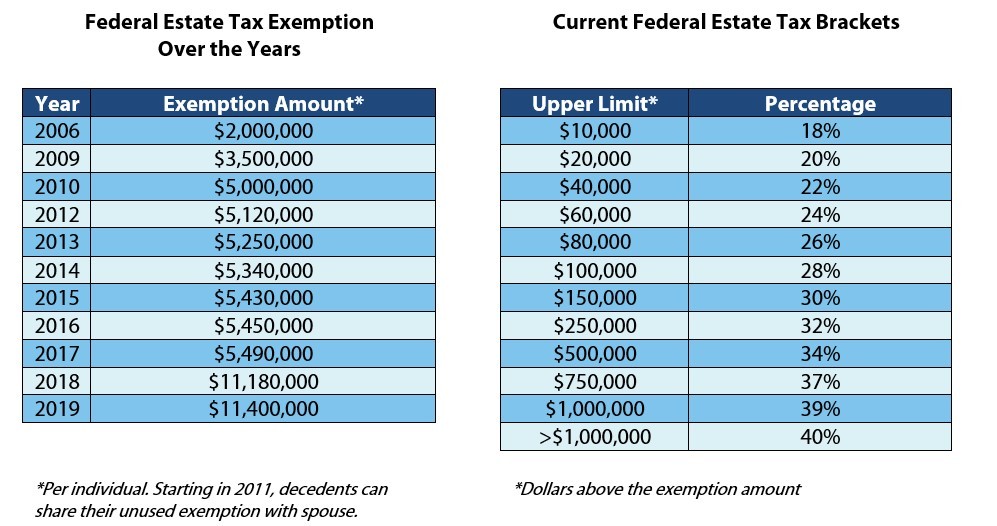

Ad From Fisher Investments 40 years managing money and helping thousands of families. The latest word from the Biden administration is that the estate tax exemption will be reduced effective January 1 2022 from the current 117 million per person enacted by the Trump administration in 2017 to the previous Federal limit of 5 million adjusted for inflation. Note that when using EFTPS you will not use the table of codes listed below.

This provision is called portability and it can be a valuable tool for married couples to consider as they develop their estate plans. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. If you are married you also have the option to transfer all or part of your estate tax exemption to your surviving spouse.

The option of portability can make a significant difference when it comes to taxation of an estate. Remember that every person is entitled to an estate tax exemption. It is historically very high.

So there is a federal gift and estate tax and it applies to transfers during life and upon death. Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life andor estate tax at the surviving spouses death. Note that the exclusion is also commonly referred to as the estate exemption.

Allowing the unused estate tax exemption amount to be portable to the surviving spouse would dramatically change the. Ad Browse Discover Thousands of Law Book Titles for Less. Every individual has an exemption from gift and estate tax that they can apply to transfers.

A surviving spouse can get a big federal estate tax break if the deceased spouse didnt use up his or her individual estate tax exemption. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. Thanks to the portability rule the survivor can use whats left.

In order to prevent the loss of husbands 1206 million exemption a portability election must be made on a timely filed estate tax return for his death. This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to 2406 million after both have died. If you have need assistance with using EFTPS contact EFTPS Tax Payment Customer Service at 800-555-4477 Businesses or 800.

Consequently a married couple is no longer penalized for doing little or no planning. As a part of the resolution to the fiscal cliff the american taxpayer relief act of 2012 atra extended and made permanent a number of important tax code provisions that impact estate planning including the now-525 million estate tax exemption after inflation indexing and the portability of a deceased spouses unused exclusion amount. That gives the couple a total exemption of more than.

There is no fee to use EFTPS. You will want to be aware that portability may not be the right decision for your situation if for example you choose to divide. However now portability is permanent and it can have more of an impact than couples may think on their financial situation upon a spouses death.

Currently that exemption is 117 million per person. Electing to use estate tax portability makes a significant difference in your federal estate tax liability. This filing ports or.

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The 2017 Estate Tax Exemption The Ashmore Law Firm P C

Estate Tax Introduction Video Taxes Khan Academy

Estate Taxes Under Biden Administration May See Changes

Estate Planning Technique Grantor Retained Annuity Trusts C W O Conner Wealth Advisors Inc Atlanta Georgia

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

Exploring The Estate Tax Part 2 Journal Of Accountancy

Tax Related Estate Planning Lee Kiefer Park

Pin By Debbie Wolfe On Trusts Revocable Trust Living Trust Estate Tax

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Historical Estate Tax Exemption Amounts And Tax Rates 2022

A New Era In Death And Estate Taxes

Federal Estate Tax Portability The Pollock Firm Llc

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

This First Installment Of A Two Part Article On Everything Practitioners Should Know About The Estate Tax Includes The Unified Estate T Estate Tax Home Estates